amazon flex tax documents canada

Click ViewEdit and then click Find Forms. Welcome to the Amazon Flex program the Program.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

AGI over 150000 75000 if married filing separate 100 of current year taxes.

. 90 of current year taxes. How Much To Put Away For Quarterly Taxes. 110 of prior year taxes.

To access a digital copy of your form please follow these steps. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. We know how valuable your time is.

The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or. Adjust your work not your life. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906. With Amazon Flex you work only when you want to. We would like to show you a description here but the site wont allow us.

Click Download to download. 12 tax write offs for Amazon Flex drivers. Or other proprietary information including images text page layout or form of Amazon without express written.

Sign in using the email and password associated with your account. Select Sign in with Amazon. Whatever drives you get closer to your goals with Amazon Flex.

Tap Forgot password and follow the instructions to receive assistance. Driving for Amazon flex can be a good way to earn supplemental income. Hover over your email address displayed in the top right.

How to Calculate Your Tax. 100 of prior year taxes. Knowing your tax write offs can be a good way to keep that income in.

The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances. The forms are also sent to the IRS so take note if youve made more than 600.

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

/https://www.thestar.com/content/dam/thestar/business/2020/06/26/amazon-delivery-drivers-in-canada-launch-200-million-class-action-claiming-unpaid-wages/amazon.jpg)

Amazon Delivery Drivers In Canada Launch 200 Million Class Action Claiming Unpaid Wages The Star

Biden Proposal For Electric Vehicle Tax Credits Irks Canada And Mexico The San Diego Union Tribune

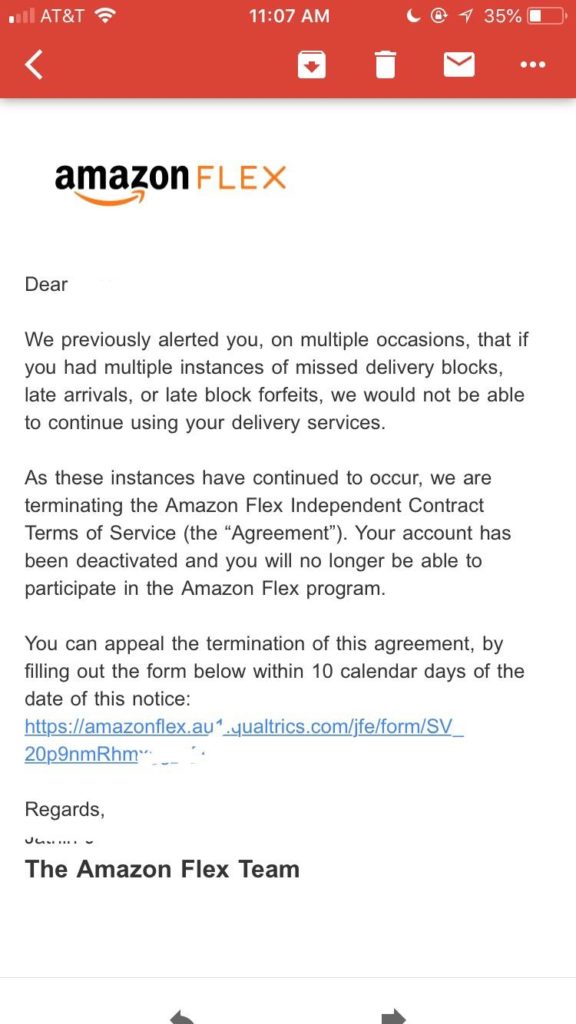

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

How To Apply For Amazon Flex Driver Jobs Career Info

Everything You Need To Know About Amazon Flex Gridwise

After December Walkouts Organized Amazon Workers In Chicago Area Eye Next Steps Chicago News Wttw

Tax Deductions For Uber Lyft And Amazon Flex Drivers How To File The Perfect Tax Return Youtube

Amazon Tax Guide For Canadian Sellers In The United States Canada Baranov Cpa

Tax Forms Email R Amazonflexdrivers

Frequently Asked Questions Us Amazon Flex

Gamestop Sinks As Short Squeeze Bet Fades The New York Times

Ideapad Flex 5 15 Flexible 15 6 2 In 1 Laptop Lenovo Us

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

23 Apps Jobs Like Amazon Flex To Earn Money Making Deliveries Appjobs Blog